Post-BNPL Scalapay is Italy’s first unicorn after a $497 million funding round appeared on the Silicon Republic. Fintech startup Scalapay became Italy’s first unicorn after raising $497 million (€444.6 million) in a Series B investment funding round.

Fintech startup Scalapay is valued at more than $1 billion (€890 million) following a funding round led by Tencent and Willoughby Annunci69 Capital, involving Tiger Global, Gangwal, Moore Capital, Deimos, and Fasanara Capital. The acquisition, backed by Tiger Global, is the industry’s latest unicorn after raising about $497 million in new funding from Chinese tech giant Tencent and U.S. firm Willoughby Capital.

The Tiger Global-backed acquisition, which raised $155 million at a $700 million valuation in August 2021, was led by Tiger Global with additional backing from Baleen Capital and other investors, including Woodson Capital Fasanara Capital and Ithaca support.

The new increase also included former backers Tiger Global and Fasanara and new investors Gangwal, Moore Capital, and Deimos.

The handover of the “buy now, pay after Scalapay” unicorn club card platform, the Series B round led by Tencent and Willoughby Capital and attended by all members of Tiger Global, Gangwal, Moore Capital, Deimos, and Fasanara Capital. The co-lead was New York-based Willoughby Capital, which previously invested in Bolt.

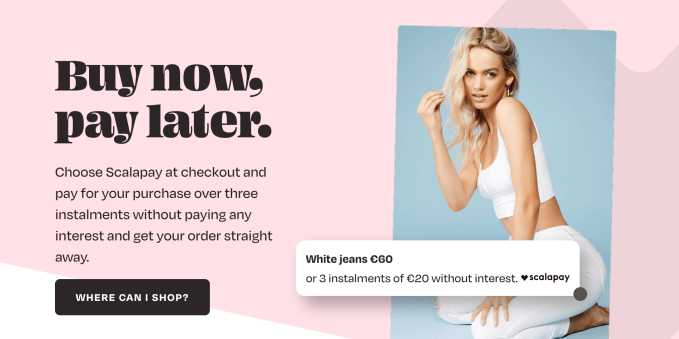

They started a new restart in November and were mandated in early December. Scalapay makes the shopping experience more enjoyable and easier for customers, facilitating the financial impact. Their BNPL offerings include three options for clients (pay in 3, pay in 4, and pay later) where clients are not required to make any payments in advance and can instead choose to pay in installments in 3 installments, four installments, or in full later.

Customers are not required to pay any money upfront and can choose to pay in three installments, four installments, or in full after 14 days. Some prefer the practical Buy Now, Pay Later (BNPL) option.

An innovative payment solution for e-commerce

Scalapay is an innovative payment solution for e-commerce merchants worldwide that allows shoppers to buy now and pay later in three convenient, interest-free payments. The mission of Scalapays is to provide a global platform based on enjoyment and the best consumer choice. In addition, fintech company Scalapay has also launched a new platform called Magic, which focuses on the payment experience for customers.

Companies using Fintech’s Scalapay services include Decathlon, Calzedonia, Swappie, Shopify, WooCommerce, Moschino, Samsonite, Nike, and Pandora. Since creating the Milan Scalapay Youporn BNPL platform, Scalapay has supplied its companies in Italy, France, Germany, Spain, Portugal, Finland, Belgium, the Netherlands, and Austria.

BNPL Solution Scalapay also recently launched the Magic Embedded Payment Processor, which aims to fix cart abandonment during checkout and registration, login, and shipping issues. Last year, Tiger Global launched its new Magic checkout product, which Scalapay says reduces friction for customers and increases shopping cart size for merchants. BNPL’s Scalapay solution works with retailers like Nike, Decathlon, Moschino, and more to increase average cart size by 48% and checkout conversions by 11%.

The first fintech unicorn in Italy

BNPL’s Scalapay solution is now the first fintech unicorn in Italy after the latest $497 million in Series B funding, raising the total to $1.2 billion. Italy’s fintech equity and debt consist of $213 million in equity and $284 million in debt. The investment is valued by Amber, who is also based in Singapore, at $3 billion, and the total capital raised by Amber to date is $328 million.

The company, now called Block, operates an FDIC-insured bank, a consumer payments platform, offers stock and crypto trading, and has made several high-profile acquisitions. Alpha Wave’s first $75 million has been paid, as evidenced by the Singapore company’s regulatory filings. The funding round is the latest move by CEO Anthony Knotos to transform accounting software startup Vancouver Bench into a full-service bank.

Fintech firm Scalapay now plans to double its headcount by the end of the year and expand its board of directors. Today is a big day for Italy as the $497 million Scalapays Series B payment platform gives the country its first unicorn since the dot-com boom. Since Scalapay’s recent Serie A round, Scalapay has tripled its payout month on month.

Asked if the choice of New York-based Tencent and Willoughby Capital was driven by a desire to relocate to Asia and the United States, Mancini replied that the Scalapays payment platform is focused on “deepening” its current markets rather than “broadening” expansion.

After making $155 million last September for Tiger Global, it was only a matter of time before the platform purchase paid off after Scalapay claims to be the first Italian startup with a valuation of over $1 billion. Fintech Scalapay, founded in 2019 by Simona Mancini and Johnny Mitrevski, offers BNPL (Buy Now, Pay Later) services to e-commerce companies worldwide.